When your roof suffers damage from severe weather, accidents, or other unforeseen events, the situation can quickly become overwhelming. However, understanding the steps involved in filing an insurance claim for roof damage can simplify the process. In this guide, well walk you through what is the insurance claim process for your roof, from identifying damage to receiving compensation. Following these steps will help you feel prepared and enable you to navigate the process more efficiently.

1. Assess the Damage

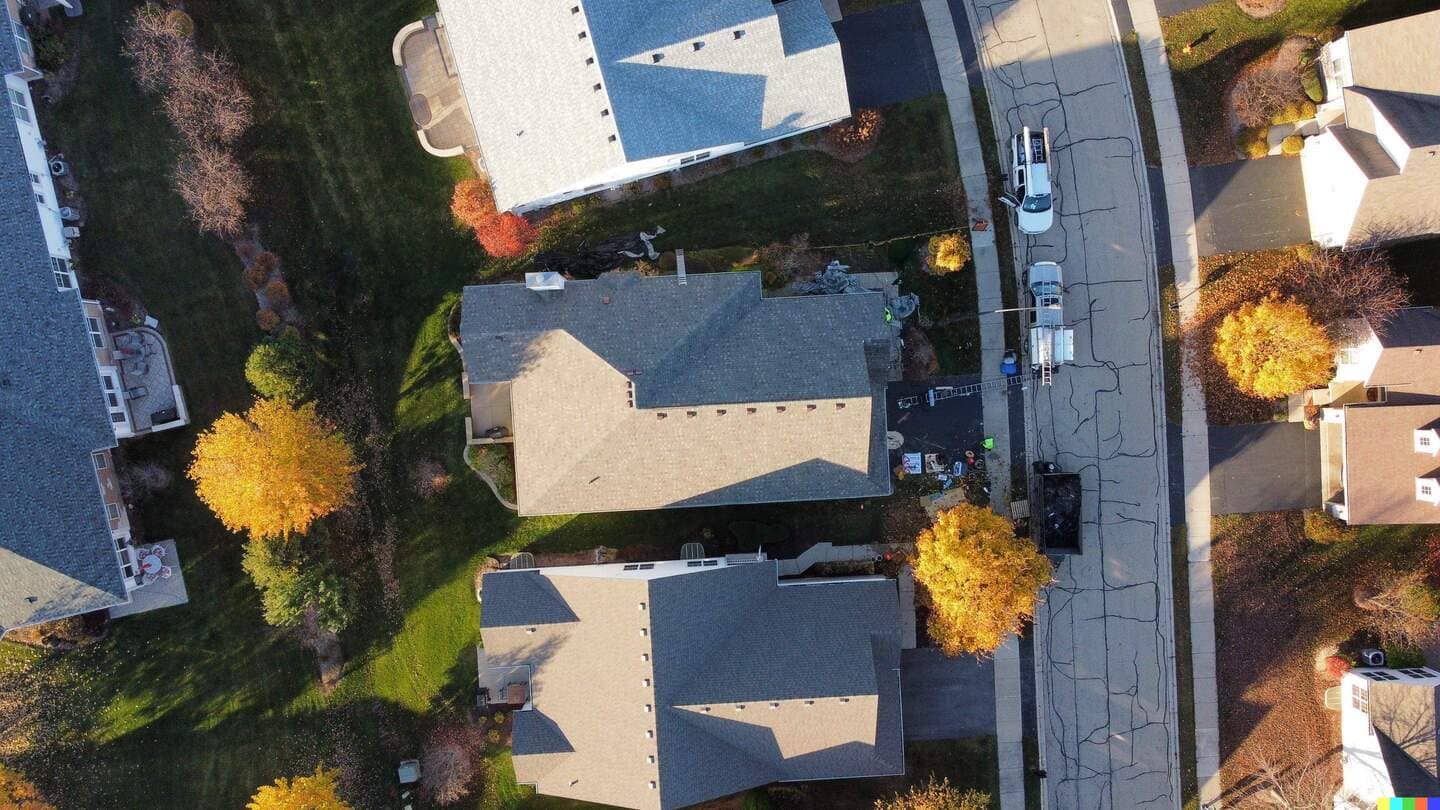

The first step in understanding what is the insurance claim process for your roof is to assess the damage thoroughly. After a storm or incident, inspect your roof for visible signs of trouble like missing shingles, cracked tiles, or hail dents. If the damage seems extensive, call a professional roofing contractor to inspect it. They can give you a detailed damage report, which you will need for your claim.

Additionally, document everything thoroughly. Take clear photos and write notes about the damage. These records will support your claim when you file it. Check both the exterior and interior of your roof for leaks, water damage, or structural issues.

2. Review Your Insurance Policy

Before moving forward, take time to review your insurance policy carefully. This step is crucial in what is the insurance claim process for your roof. Your policy details what types of damage are covered and any exclusions. For example, most homeowners insurance covers weather-related damage but might not cover wear and tear or poor maintenance.

Its also important to know your deductible, the amount you must pay out of pocket before the insurance covers the rest. Knowing your coverage and deductible helps you set clear expectations about your claim.

3. Contact Your Insurance Company

Once you've assessed the damage and reviewed your policy, the next step in what is the insurance claim process for your roof is to contact your insurance provider. Most companies have a deadline for filing claims, typically between 30 and 60 days after the incident.

When you call, have your policy number ready and provide specific details about the damage. The insurance company will open your claim and schedule an adjuster to inspect your property. At this point, ask for a timeline and any documents youll need to submit.

4. Hire a Roofing Contractor

Hiring a qualified roofing contractor is another key step in what is the insurance claim process for your roof. Some insurance companies may recommend contractors, but you have the right to choose your own. Just make sure they are licensed and experienced in handling insurance claims. A good contractor will inspect your roof, estimate repair costs, and communicate with the adjuster.

Choosing a contractor who specializes in insurance claims will ensure all the damage is properly documented. This helps avoid complications during the claim process.

5. Meet with the Insurance Adjuster

Your insurance company will send an adjuster to inspect your roof and verify the damage. This meeting is crucial in what is the insurance claim process for your roof. The adjusters role is to confirm whether the damage falls under your policys coverage.

Having your contractor present during the adjusters visit is a smart move. Your contractor can help point out damage and provide insight into the repairs needed. After the inspection, the adjuster will submit their report to the insurance company, which determines the outcome of your claim.

6. Receive the Claim Decision

After the adjuster submits their findings, your insurance company will review the report and issue a decision. This part of what is the insurance claim process for your roof determines whether your claim will be approved, denied, or requires additional information.

If approved, the insurance company will send a payout based on the adjusters estimate, minus your deductible. This money usually covers the cost of repairs or replacement. For larger repairs, the insurer may release the funds in stages.

If your claim gets denied, review the reasons. In some cases, claims are denied due to missing or unclear documentation. You can appeal the decision, but make sure you provide any additional information the insurer might need.

7. Start Roof Repairs

Once your claim is approved, the next step in what is the insurance claim process for your roof is to start the repairs. Work with the roofing contractor you initially hired, or choose another qualified professional. Be sure to document all work, keep receipts, and organize contracts.

Make sure the repairs match the recommendations in the adjusters report. If anything unexpected arises during repairs, inform your insurance company immediately. This prevents issues with your claim and ensures you dont face additional out-of-pocket costs.

8. Finalize the Insurance Claim

After repairs are complete, the final step in what is the insurance claim process for your roof is closing the claim. The insurance company may send an adjuster to inspect the finished work and confirm everything was completed correctly.

Once theyre satisfied, the insurer will release any remaining funds to cover the full cost of repairs. Complete all necessary paperwork and make sure your claim is officially closed. This ensures that you wont face any lingering issues with the process.

Preventing Future Roof Damage

After going through what is the insurance claim process for your roof, youll likely want to avoid future roof damage. Preventative maintenance, such as regular roof inspections and repairs, can significantly reduce the risk of damage. Taking proactive steps now can help extend the life of your roof and reduce the likelihood of needing another insurance claim in the future.

Common Mistakes to Avoid During the Insurance Claim Process

- Delaying the Claim: File your claim as soon as you notice the damage. Waiting too long can result in missed deadlines and claim denials.

- Not Understanding Your Policy: Misunderstanding your policy can lead to unexpected out-of-pocket expenses.

- Poor Documentation: Failing to provide complete records of the damage can weaken your claim.

- Ignoring Contractor Assistance: A professional contractor helps document the damage and can assist you throughout the process.

Conclusion: Be Prepared for the Insurance Claim Process

Navigating what is the insurance claim process for your roof may seem complex, but it becomes manageable when youre informed and prepared. From assessing the damage and reviewing your policy to working with contractors and adjusters, each step is essential to getting your claim approved. By taking control of the process, documenting everything, and understanding your coverage, you can ensure a smoother experience and get your roof repaired without unnecessary stress.

Your roof is one of the most important parts of your home, so taking care of the claim process correctly is crucial. A well-handled claim will protect your property and your peace of mind.

FAQs

1. How long does the insurance claim process take?

The process varies depending on the extent of the damage and your insurance company, but it typically takes a few weeks to several months.

2. Will my premium increase after filing a roof claim?

It depends on the insurance company and the type of claim. In some cases, your premium may rise, especially in areas prone to frequent storms.

3. What happens if my roof damage is due to poor maintenance?

Most insurance policies dont cover damage caused by poor maintenance or wear and tear. Regular upkeep can help avoid these issues.

4. Can I choose my own roofing contractor?

Yes, you can choose your contractor, provided they are licensed and insured. Your insurance company may have recommendations, but youre not obligated to use them.

5. What if my roof claim is denied?

If denied, review the reasons and gather more documentation. You can appeal the decision with additional evidence.

6. Can I file a claim for a full roof replacement?

If the damage is severe, some insurance policies may cover a full roof replacement. The adjusters report and your policy will determine this.

View our insurance claim page for more information, or book free inspection here.